Thailand’s Star Turn: How Alien: Earth (and a wave of A-List Productions) Is Reshaping Film Tourism, Rentals, and Real Estate

Part 1 — Alien: Earth in Thailand: A Production Case Study With Real-World Ripple Effects

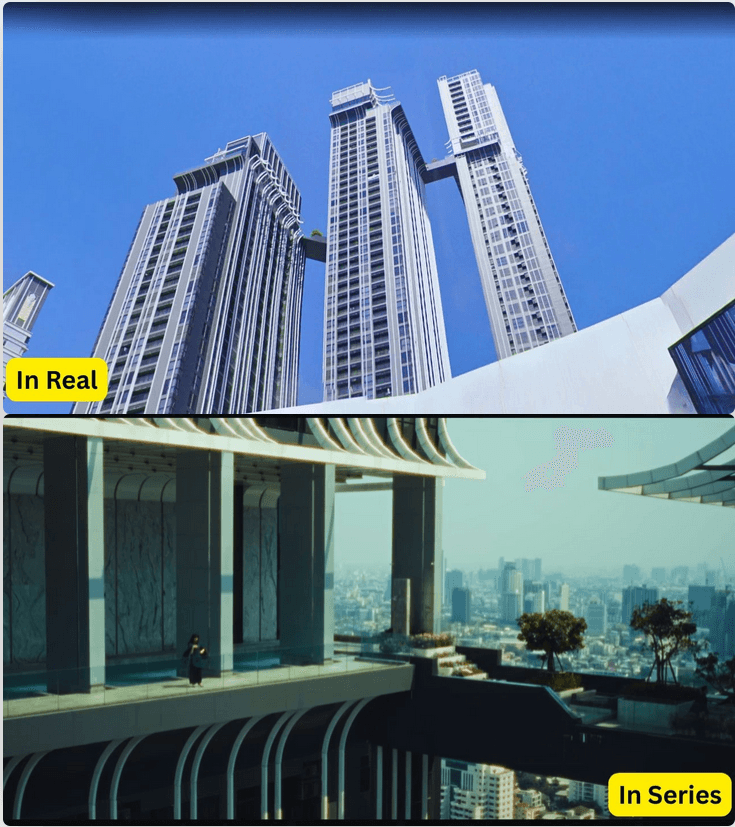

When FX/Hulu announced Alien: Earth — a high-budget series set just before Ridley Scott’s original timeline — few expected its signature city, “New Siam,” to be conjured almost entirely in Thailand. But Thailand’s unique blend of hyper-modern skyline and otherworldly limestone seascapes gave the show its look; the corporate verticality of Bangkok for the city, and the cinematic karst of Krabi/Phang Nga for atmospheric exteriors. Publications from Wired and The Verge highlighted how the show’s chilling corporate dystopia leans on Bangkok’s layered urbanism, while Time Out explicitly confirms the Thailand locations that underpin the entire production.

What does Thailand bring to the table?

1. A complete palette in one country.

Producers could shoot futuristic cityscapes (Bangkok), grand interiors and stages (around Samut Prakan/Bangkok), and alien-looking natural worlds (Krabi, Phang Nga, Phuket) without continent-hopping. That’s extraordinary for scheduling, insurance, and budget.

2. Tiered rebates up to 30% on qualified local spend (effective 2025), turning Thailand from a beautiful location into a financially strategic one. That parity with leading incentive markets matters when streamers and studios juggle eight-figure budgets.

3. Deepening crew base and infrastructure.

Over the past decade, Thailand developed a robust English-speaking crew

ecosystem, specialist SFX capability, marine coordination, and competitive

post options. Productions can scale quickly—evident from The White Lotus’s multi-province shoot and Alien: Earth’s complex stunts/FX.

4. Narrative authenticity.

Alien: Earth imagines a water-logged, stratified “New Siam.” Using Thailand for “New Siam” isn’t just pretty — it’s diegetically elegant, especially for the scenes centered around Prodigy and its domination efforts. The visual language of the series borrows real textures from Thai urbanism and dramatic coastlines, grounding its sci-fi plausibility. (WIRED)

The headline: Thailand didn’t merely host Alien: Earth — it shaped it.

Image credit: https://a2zfilminglocation.com/fxs-alien-earth-filming-locations-2025/

Part 2 — Why Global Producers Keep Choosing Thailand (and Why 2025 Is a Tipping Point)

1) Incentives that finally match the imagination

For years, Thailand was an A-list location with B-list incentives. That changed, and as of January 2025, productions can access cash rebates up to 30% (tiered, subject to spend and criteria). Government sites and the Tourism Authority of Thailand confirmed the upgrade, which directly impacts above-the-line decisions, like, “Do we build here or elsewhere?”

2) Record foreign spend = real momentum

Foreign productions injected a record ~2.87 billion Baht in H1 2025 alone, as per The Nation, linked explicitly to the rebate scheme. Momentum begets momentum, and once a place is on every line producer’s shortlist, it benefits from a virtuous cycle of crew retention, equipment investment, and repeat projects. We even met a set builder recently who was flying back to Bangkok to work on a series of new productions (Olly, it was great to meet you, and happy you survived the Hainan two-day flight push!)

3) “Set-jetting” demand is proven — The White Lotus effect, and Crazy Rich Asians before that.

HBO’s The White Lotus (Season 3) put Phuket, Koh Samui, and Bangkok on luxury travelers’ minds at the same time. Pre- and post-launch coverage flagged these locations and specific hotels/studios, with Forbes and other outlets documenting the surge in traveler interest and bookings. This kind of spotlight reliably spills over into lifestyle rentals and second-home searches, especially at the upper end.

4) Versatility: cyber-city to castaway paradise

Few countries can deliver:

Blade Runner-esque skylines and elevated expressways (New Siam feel)

- Monsoon-green jungles and karst seascapes (Krabi/Phang Nga)

- Deserted beaches and yacht-friendly bays (Phuket/Andaman)

… all within short flights and robust crew availability. Thailand can — and

that’s production gold. (Time Out Worldwide)

Image credit: https://a2zfilminglocation.com/fxs-alien-earth-filming-locations-2025/

There’s a well-documented arc to film-induced tourism: screen exposure → travel curiosity → destination visitation → longer stays(remote workers, production returnees, creatives) → housing demand.

Academic literature links media exposure with measurable changes in visitor flows, and even real estate outcomes (greater rental prices and investment interest) once destinations become aspirational.

In Thailand, that arc is unfolding in real time. Now everyone can hear you scream!

Short-term: spikes in hotel and short-let occupancy after a show’s premiere (The White

Lotus S3). That pressure can “spill” into serviced apartments and Airbnbs, particularly in the featured locales.

Long-term: investors and expatriates focusing on second homes and income properties in places whose image got an upgrade—Phuket, Samui, Krabi, Phang Nga, and select Bangkok districts.

What the early numbers hint at ...

Phuket has been a standout: CBRE noted extraordinary growth into 2024 (e.g., a

>200% YoY jump in condo sales at end-2024; separate coverage cites villa transactions jumping as well). While many forces are at play (post-pandemic luxury migration, remote work, yacht culture), the screen halo from prestige productions accelerates global mindshare.

At the national level, Thailand’s residential price indices show gradual growth through 2024, despite cyclical headwinds—suggesting that spotlighted sub-markets can outperform the national median.

At the national level, Thailand’s residential price indices show gradual growth through 2024, despite cyclical headwinds—suggesting that spotlighted sub-markets can outperform the national median.

Caution, but with conviction: Macro property cycles still matter (e.g., Bank of Thailand policy moves and credit conditions). Yet the micro-markets touched by marquee shows often pull ahead — first in rentals, then invalues — because they attract higher-spending tenants and buyers who are responding to lifestyle branding as much as fundamentals. (Reuters)

Part 4 — Where Alien: Earth (and Its Successors) Will Likely Boost Demand

1) Bangkok: New Siam, new tenants

Who moves in:

Creative professionals, tech expats, and hybrid-work tenants drawn by the show’s

ultra-modern imagery and the reality of co-working hubs, international schools, Michelin dining, and flights to everywhere.

Production companies booking multi-month apartments for rotating teams (writers’ rooms, post, VFX, ADR).

Sub-markets to watch:

Rama IV & Sukhumvit corridors (Asoke–Phrom Phong–Thonglor–Ekkamai): high-spec condos with on-foot access to BTS/MRT and amenities.

Riverside (Charoenkrung–Sathorn): cinematic views + prestige hotels, a brandable lifestyle for HNWI rentals.

Samut Prakan edges (near studio zones): value plays for production-adjacent housing.

What typically happens first: elevated occupancy and nightly/weekly rates for top-spec units; then renewals at higherrents as long shoots roll over.

Image credit: https://a2zfilminglocation.com/fxs-alien-earth-filming-locations-2025/

2) Phuket & the Andaman coast: the glossy postcard becomes reality

Alien: Earth and The White Lotus share a key asset: Thailand’s jaw-dropping seascapes. Once those go global, demand follows.

Who moves in:

Long-stay “set-jetters,” yacht and dive communities, and digital creatives chasing a

location-independent lifestyle.

- Crew bases for marine filmmaking, stunt/rehearsal camps, and ad/TV shoots.

- Sub-markets to watch:

- Mai Khao–Nai Thon–Bang Tao/Laguna: luxury villas, branded residences, and family-friendly serviced apartments (international schools, golf,

marinas).

Chalong–Rawai–Nai Harn: good value for crew housing and mid-term leases.

- Kamala–Surin–Patong ridges: sea-view villas that photograph—and rent—exceptionally well.

Market signals (2024–2025): analyst and brokerageupdates point to exceptional absorption and foreign-buyer dominancein Phuket, with transaction values hitting multi-year highs. That aligns with what we see globally when premium TV spotlights a destination.

Epic spires, hidden lagoons, cave systems — the on-screen “alien” feel is precisely the off-screen selling point.

Investor angles:

Eco-boutique villas with on-site staff (photogenic and Instagram-ready).

- Retreat properties (yoga/film residencies) riding media cachet.

- Marine access (private piers, speedboat partnerships) for cast/crew logistics.

Risks to price in: carrying capacities andconservation rules. The arc of “fame → overtourism” is real; choose districts with infrastructure and permitting clarity.

Part 5 — Rental and Sales Strategy: How to Be Early (But Sensible)

A) For landlords & developers

Design for film-crew realities.

Lockable storage, dual workspaces, blackout options, robust Wi-Fi

redundancy, and month-to-month pricing. That’s what keeps productions renewing.

Amenity storytelling.

If your location appears (or resembles) a series setting, brand the listing accordingly—without infringing IP. “Minutes from lagoon where [production descriptor] filmed exterior sequences” converts browsers to bookers.

Corporate let packaging.

Studios and agencies prefer one invoice, one point of contact. Bundle airport transfers, housekeeping, and a “fixer” concierge.

ESG-ready properties.

Major productions carry sustainability goals. Solar, water-saving,

recycling, and carbon-lite transport add procurement appeal.

B) For buyers & investors

Follow the call-sheet, not the headlines.

Production activity clusters near studios, unit bases, and marine operators — not just the postcard beach. Buying within 30–45 minutes of those hubs can outperform.

Prioritize legal clarity.

In resort provinces, pick projects with clean title, strong juristic

management, and transparent rental programs. In Bangkok, ensure foreign quota availability for condos and understand LTV/fee changes. (Reuters)

Model three scenarios.

Base case (tourism-led), upside (screen halo + repeat seasons), and

downside (macro dip). In Thailand, gross yields can remain healthy even when sales cycles pause—as long as your product answers long-stay

needs.

Mind the calendar.

Production calendars (Oct–Apr dry season for marine shoots) influence seasonality of bookings. Price accordingly and protect yield with short-gap, long-stay discounts.

Image credit: disney+ / TV Central Australia

Part 6 — Risks & Realities (So You Don’t Over-Indexon Hype)

Macro property cycle: The Thai market is cyclical and policy-sensitive (LTV rules, transfer fee holidays). A strong micro story (e.g., Phuket’s run) can still sit inside a lumpy national cycle. Buy quality, not just a TV view.

Sustainability & carrying capacity: Some beaches and parks face visitor limits. Properties that embrace sustainability and spread demand inland or to less-visited bays will be more resilient.

IP & marketing ethics: You can’t use show logos or claim official ties without permission. Market the lifestyle and geography, not the brand you don’t own.

Liquidity: Villas are lifestyle assets; liquidity can be slower than city condos.

Price with a five- to seven-year horizon.

Part 7 — What to Watch Next; Streamers show the way

Renewals and spin-offs: If Alien: Earth returns or parallel projects choose Thailand, expect multi-year crew pipelines benefiting the same accommodation nodes. (The Verge)

More prestige TV in the pipeline: After The White Lotus and Alien: Earth, showrunners have a template for “Thailand as character.” It won’t be the last. (Forbes)

Incentive stability: The 30% ceiling is competitive; the key is administrative clarity and speed. Monitor TFO/TAT updates to gauge how friction-free rebates feel in practice.

Data beats vibes: Track occupancy, ADR and absorption in your target micro-market (Bang Tao, Chalong, Krabi Town, Ao Nang, etc.) against premiere dates and filming windows.

Part 8 — Actionable Playbooks

If you’re a landlord in Bangkok

Outfit a 1–2 bed condo (Asoke/Phrom Phong/Thonglor) with dual-desk work zones, keyless entry, pro-grade coffee, and bi-weekly housekeeping.

- Set production-friendly terms (45–90 day blocks, simple addenda for early wrap).

Partner with local fixers who can source gear, cars, and translators.

If you’re a villa owner in Phuket/Krabi/Phang Nga

Shoot a cinematic walkthrough (drone + dawn/dusk shots).

Build concierge bundles: marina pickup, island-hop day rates, on-call chef, yoga teacher, and quiet hours for script work.

Offer crew-rate menus in shoulder months to maintain 80–90% occupancy.

If you’re an investor choosing between city and coast

City - (Bangkok): higher liquidity, corporate demand, BTS/MRT adjacency premium.

Coast - (Phuket/Andaman): higher nightly rates potential, stronger lifestyle pull, but plan for seasonality and management quality.

Earth - The Final Frontier, or simply the 'Bottom Line' for business, with Thailand leading the Force for Good?

Alien: Earth didn’t just use Thailand; it showcased why Thailand works for global storytelling—financially, logistically, andartistically. With rebates up to 30%, record foreign production spend,and marquee titles like The White Lotus turning the spotlight to Phuket, Samui and Bangkok, it’s no surprise the rental market is tightening and selectsales markets (especially Phuket) are outperforming.

If you’re a landlord, tailor your product to long-stay,high-spec renters whose work and lifestyle are global. If you’re a buyer,pick micro-markets with studio/marine proximity and strong management.And if you’re a developer, build for ESG-aligned productions and set-jettingtravelers who now see Thailand not just as a holiday but as a 'home base'.

Thailand’s star turn is just getting started. The smartest money gets in before the next season drops.

Thailand’s star turn is just getting started. The smartest money gets in before the next season drops.