Thailand Residential Property Market Report (2020–2025)

By Prime Property Thailand: the 5-year Sentinel Report (2020–2025)

Introduction

This comprehensive report analyzes the growth in the value of condominiums and houses across various regions of Thailand between 2020 and 2025.

Drawing on data from national price indices, developer reports, and global real estate trends, we break down historical patterns, regional shifts, key growth drivers, and projected opportunities for investors and homebuyers. The report includes Bangkok and its metropolitan area, Phuket,

Chiang Mai, Pattaya, the Eastern Economic Corridor (EEC), and select secondary provinces to provide a holistic view of the Thai residential real estate landscape.

1. Market Overview (2020–2025)

Thailand’s residential real estate market has shown strong resilience and recovery since the economic downturn of the COVID-19 period. While 2020 and early 2021 saw transaction volumes drop across all property types, 2022 marked the beginning of a broad rebound. Government stimulus, foreign buyer return, and urban infrastructure expansion ffueled a new cycle of growth.

1.1 Market Size and Structure

The total market size is estimated to reach USD 163 billion in 2025, up from ~USD 150 billion in 2020.

Growth has been led by condominium developments in urban centers and low-rise housing in the suburbs and upcountry zones.

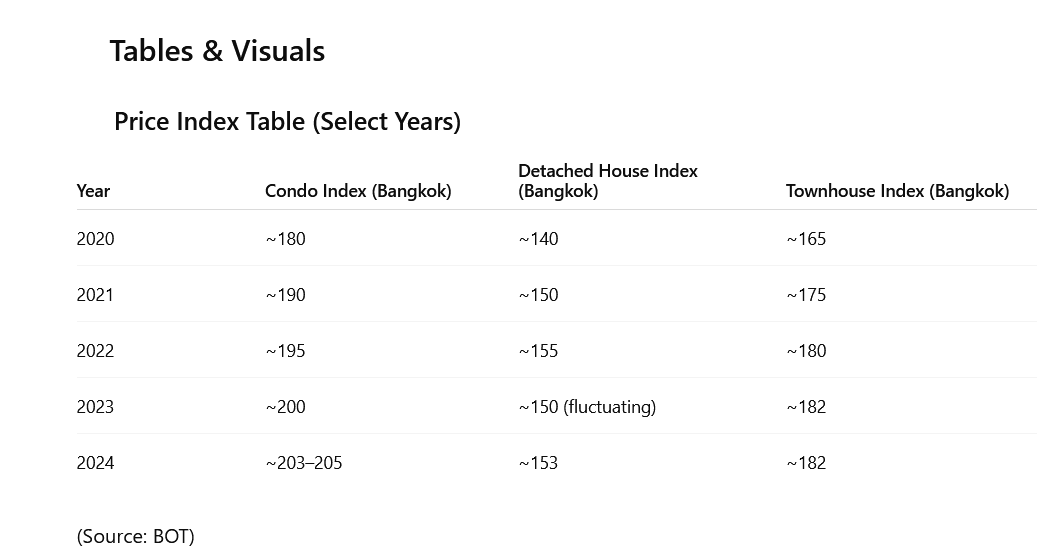

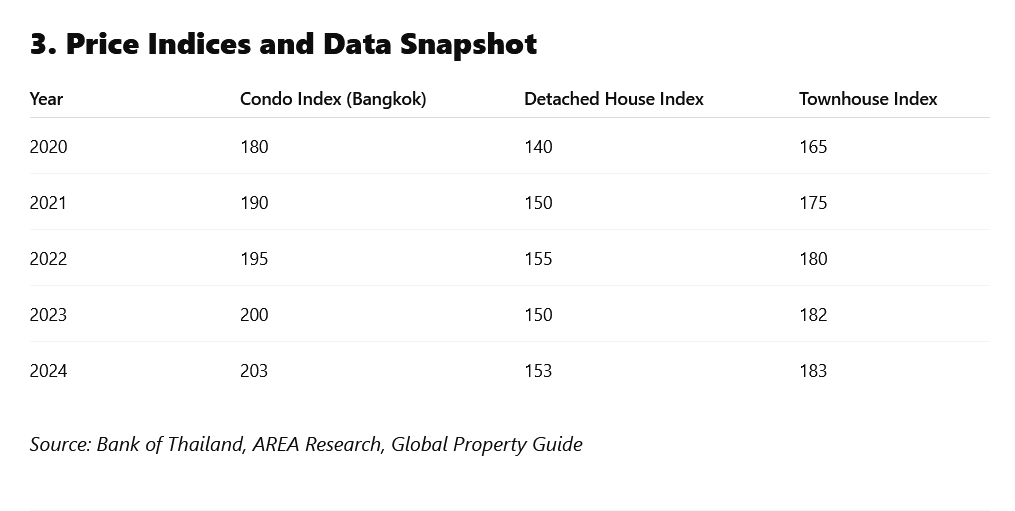

- According to the Bank of Thailand (BOT), the property price index for condominiums in Bangkok rose from ~180 in 2020 to over 203 in 2024 (see below chart).

- Townhouses and detached houses saw similar upward trends, especially in outer Bangkok, Chonburi, Rayong, and Chiang Mai.

2. Regional Performance Analysis

2.1 Bangkok & Greater Metro

Bangkok remains the epicenter of Thailand’s property market, accounting for over 60% of new condo launches and transfers nationwide. From 2020–2025:

Central Bangkok (CBD):

- Condo prices rose 12–15% cumulatively, with high-demand areas like Sukhumvit, Sathorn, and Silom seeing average prices climb to 180,000–300,000 THB/sqm.

- Inventory levels declined post-2022, supporting price stability and resale gains.

- Suburban Bangkok:

- Townhouses and low-rise housing developments expanded rapidly in outer areas like Bangna, Ratchapruek, Rangsit, and Minburi.

- Condo projects near new transit lines (e.g., MRT Yellow Line, BTS Gold Line) gained traction with 3–5% annual growth.

- Ladprao, Huai Khwang, and Rama IX:

- These midtown zones benefited from both rental and resale demand, especially from young professionals and overseas investors.

- Capital appreciation in these areas averaged 5.6% over the 2022–2024 period.

- Market Drivers:

- Expansion of the urban rail network

- Strong demand for 1–2 bedroom condos (2–5 million THB), with Thais investing for medium term capital appreciation gains, while foreigners look to leave European markets due to extremely high cost of rent/purchase in many Western cities.

- Relaxation of LTV (Land Tax) requirements in 2021–2023

- 2.2 Phuket

- Phuket's property market has transitioned from a tourism-reliant model to one also supported by foreign retirees, digital nomads, and long-term investors - as well as those pursuing innovative social media-oriented content production locations and shared houses for mutalized investment.

Key Areas: Patong, Kamala, Surin, Rawai, Nai Harn, and Bang Tao

Condos:

Prices rose by 8–10% annually since 2022, especially in sea-view or beachfront projects.

- Foreign buyers from Russia, China, Australia, and Europe returned in large numbers after 2022, accounting for up to 70% of sales in some developments.

Villas:

- Luxury pool villas appreciated by 12–18% between 2022 and 2025.

- Demand outstripped supply in premium zones, pushing prices above 25 million THB for large detached homes with ocean views.

Rental Market:

- Yield for condos in tourist-heavy locations averaged 6–8% annually due to strong Airbnb demand. The locale remains less rigourously policed that metropolitan short term rental locations which have now been clamped down upon for infraction.

- Villa rentals commanded premium weekly rates during high season (November to March).

Growth Forecast:

- Infrastructure upgrades, such as the proposed second airport and light rail, will further boost land values.

- The market is forecast to grow 10–12% YoY through 2026 if tourism maintains recovery momentum.

2.3 Chiang Mai

Chiang Mai is Thailand’s cultural hub and a magnet for retirees, digital workers, and domestic buyers seeking a cooler climate and slower pace of life.

Core City Areas: Nimman, Old City, Santitham, and Chang Phueak

Suburban Areas: Hang Dong, Mae Rim, San Sai, Doi Saket

- Condominiums:

Prices in central Chiang Mai rose modestly (~3–5% annually).

- Newer low-rise condo projects in Nimman and along the Superhighway offer competitive units at 60,000–85,000 THB/sqm.

Detached Homes & Townhouses:

- Popular among families and retirees.

- Moderate appreciation (~4–6%) with stable demand and long sale cycles.

Challenges:

- Foreign buyers face stricter ownership limits and financing challenges.

- Market is highly seasonal with limited speculative activity.

2.4Pattaya and Chonburi (EEC Corridor)

As part of Thailand’s flagshipEastern Economic Corridor (EEC), Pattaya, Chonburi, and surrounding towns have emerged as a new growth frontier.

Pattaya:

Condo prices surged 6–8% annually post-2022.

High foreign buyer interest from China, Russia, and India.

- Popular for rental returns (yielding 6.1% on average) and relatively low entry prices (~60,000–90,000 THB/sqm).

Chonburi & Laem Chabang:

- Focus on industrial worker housing, townhouses, and mixed-use developments.

- Land appreciation driven by high-speed rail and port development.

Notable Trends:

- Resale condos saw up to 30% value growth in high-demand areas during 2024.

- Developers focusing on affordable units with modern design, smart home integration, and shared co-living facilities.

2.5 Other Secondary Cities

Khon Kaen, Nakhon Ratchasima, Udon Thani:

Low but stable appreciation in the range of 2–4% per annum.

Target demographic: civil servants, teachers, hospital staff.

- Hua Hin & Khao Yai:

- Resort-style markets with villas and retirement condos.

- Moderate growth (4–6%), good long-term lifestyle investment potential.

- 3. Price Indices and Data Snapshot

4. Investment Outlook and Forecast (2025–2030)

Key Projections

Bangkok CBD Condos: 5–7% annual price growth

Suburban Townhouses: 3–5% annual gains, strong rental appeal

Phuket Villas: 10–12% per annum forecast, driven by global lifestyle buyers

Chiang Mai Condos: 3–4% annual appreciation, limited inventory

EEC Resale Condos: Up to 30% gain in high-demand zones

Growth Drivers

Government-backed megaprojects (railways, ports, SEZs)

Middle-class expansion and urban migration

Remote work and retirement-driven lifestyle buying

- Foreign ownership incentives and land lease structuring

- Risks

- Rising interest rates and mortgage restrictions

- Foreign ownership caps (e.g., 49% condo foreign quota)

- Overdevelopment in tourist zones during economic downturns

5. Strategic Recommendations

- Target Bangkok suburbs: Townhouses near MRT/BTS expansions offer stable mid-term returns.

Invest in Phuket villas: Focus on sea-view or walk-to-beach units for both yield and appreciation.

Consider Pattaya-Chonburi resale condos: Fastest growing resale segment with rental upside.

Explore Chiang Mai low-rise homes: Ideal for long-term hold with steady end-user demand.

Monitor EEC infrastructure zones: Strategic locations will outperform national average growth through 2030.

Conclusion

- Between 2020 and 2025, Thailand’s housing and condominium markets have moved through a cycle of contraction, recovery, and growth. Despite macroeconomic challenges, regional developments across Bangkok, Phuket, Pattaya, Chiang Mai, and the EEC have shown strong

resilience. - With the right project selection and location insight, investors can find both capital growth and stable rental yields in Thailand’s dynamic and maturing residential market.

- The coming five years will see increased demand from digital workers, retirees, and regional investors — all looking for affordability, lifestyle, and long-term value in Southeast Asia’s

second-largest real estate market. While living costs remain massively overinflated in Western ecnonomies, the underlying value and subseqent asset value appreciation is almost certainly guaranteed.

Disclaimer

The information provided in this report is intended for general informational and provisional research purposes only. While every effort has been made to ensure the accuracy and reliability of the data and commentary contained herein, no guarantees are made regarding its completeness, accuracy, or applicability to individual circumstances.

Property prices can rise or fall depending on a wide range of economic, legal, and market conditions. All real estate investments carry inherent risks, including the potential loss of capital. Past performance is not indicative of future results.

This report does not constitute financial, legal, investment, or tax advice. Readers are strongly encouraged to seek independent professional advice before making any investment decisions. Neither the author nor publisher shall be held liable for any loss or damages arising directly or indirectly from the use of this information.

People Also Search For: